Indian farmers have been facing a major crisis since last year because of shortages in the availability and an unprecedented rise in prices of fertilizers. Fertilizers are a critical input for agriculture and a shortage in supply can significantly undermine national food security. Given this, secured supply of fertilizers is a key strategic interest for India. Although the government has increased subsidies to bring the prices down, this has not resolved the immediate problems. Also it has also not taken any serious actions to deal with the structural causes of the ongoing crisis.

The roots of the present crisis lie in wrong policies, adopted over the last two decades that have undermined domestic production of fertilizers led by the public sector and increased dependence on imports and production by the private sector. Given that India does not have key raw materials for producing fertilizers, strategic planning by the government to secure supplies of raw materials and produce fertilizers domestically has played a historic role in supporting India’s food security. Over the last two decades, this has been undermined by an increasing reliance on import of finished fertilizers and the production in the domestic private sector. The domestic private sector, in pursuit of immediate profits has however, not made adequate long-term strategic investments.

This vulnerability has come to haunt the country in recent months as disruptions in global supply chains have resulted in a sharp increase in the international price of major fertilizers. The fundamental vulnerability of India’s import dependence needs immediate interventions, along with long-term strategies for increasing domestic production.

Rise of international prices

The international price of fertilizers have been rising since 2020. The latest data from the Ministry of Chemicals and Fertilizers shows that, within a year (November 2020 - November 2021), price of a metric tonne (MT) of urea increased by 230 per cent ($280 to $923), of diammonium phosphate (DAP) by 120 per cent ($366 to $804), of ammonia by 224 per cent ($255 to $825), and of muriate of potash (MOP) by 22 per cent ($230 to $280). Within a month, between October and November 2021, the prices of urea increased by about 25 per cent ($690/MT to $923/MT) and of DAP by 15 per cent ($682/MT to $804/MT).

Disruption in supply from major exporters

The availability of fertilizers in India has become increasingly dependent on imports. In 2021, imported urea accounted for about 21 per cent (6.4 million MT) of the total available urea in the country. The corresponding share for DAP was 55 percent (4.5 million MT) and MoP was nearly 100 percent (1.5 million MT).

In recent years, China has emerged as the most important exporter of DAP to India. Globally, China accounts for nearly one-third of the total DAP trade and one tenth of urea. In 2021, 40 percent of the total Indian DAP imports were from China. However, due to an energy crisis in December 2021, China halted the exports of DAP until June 2022. This is an important cause of the sharp rise in the international price of DAP.

Along with this, with an increase in the price of natural gas, the main raw material for nitrogenous fertilizers, Russia, one of the biggest exporters of urea, has cut down exports in December 2021 and banned exports of ammonium nitrate from February 2022.

Also as noted above, MoP used in India is almost entirely imported. Belarus, one of the major exporters of MoP to India (30 percent of total imports in 2021), is facing sanctions from the United States (US) and European Union (EU). This is likely to affect both its international price and imports to India.

In addition, the recent eruption of hostilities in the Russia-Ukraine crisis and related sanctions by the EU and the US on Russia have resulted in increasing price of crude oil and Natural Gas, disruption in shipping lines and other freight movement. The crisis would inevitably further push the international price of fertilizers upwards and create havoc among the importing nations including India.

In other words, there is a simultaneous disruption in supply of all the three most important fertilizers from key exporting countries. In addition to all this, the COVID-19 pandemic and the shortages in availability of shipping containers continue to aggravate disruptions in the supply of finished fertilizers as well as key raw materials like rock phosphate and phosphoric acid.

Shortfall in domestic availability

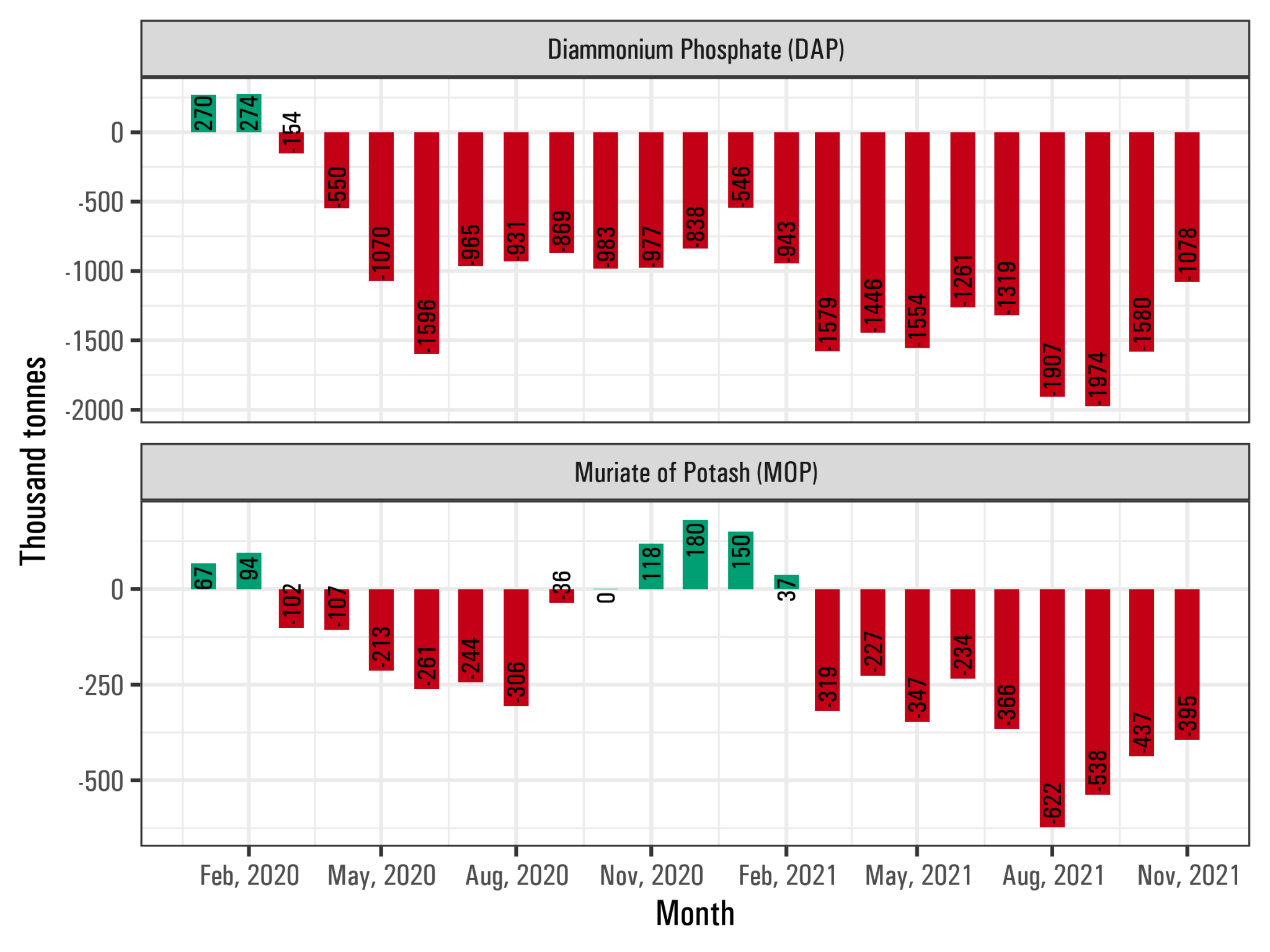

The fall in imports and shortages in supplies of raw materials for domestic producers has resulted in a crisis in availability of fertilizers across the country. The data presented in Figure 1 fly in the face of Union Minister Mansukh Mandaviya’s denial in the Parliament of any shortage in the supply of fertilizers. The Minister, instead, blamed the farmers for hoarding and black marketing.

In the case of DAP, shortage started since the beginning of the COVID-19 pandemic (Figure 1). However, instead of listening to the wakeup call and dealing with the structural weaknesses, the government initially treated it as short-term supply disruption caused by the COVID lockdown, which would vanish once transport disruptions were dealt with, and then as an issue of rising prices, that could be dealt with by temporarily increasing the subsidy. In line with this belief, the government increased the subsidy in May 2021 and again in October 2021. The crisis, however, only worsened and the shortfall in supply of DAP became more and more acute from one season to the next. Figure 1 shows that the situation with the availability of MoP has been equally grave and the trends are similar.

Figure 1: Shortfall in monthly availability of DAP and MoP in 2020 and 2021 in comparison with the corresponding month in 2019 (thousand metric tonnes)

The shortage of DAP was most acutely felt in Rabi 2021 as farmers queued up, sometimes for days, in front of fertilizer shops, cooperative societies and government offices. In many districts, rationing was imposed and farmers were sold limited quantities of fertilizer. In Lalitpur district of Uttar Pradesh, Bhogi Pal, a 55 year old farmer, died standing in the queue for buying fertilizers. In Madhya Pradesh a farmer allegedly committed suicide unable to obtain fertilizers.

The shortage of fertilizers led to widespread protests in October-November 2021, when the crisis became severe. In Hansi district in Haryana, farmers went on an indefinite hunger strike. Such protests were also witnessed in other parts of Haryana, Punjab, Uttar Pradesh and Bihar.

Government still in denial

Unfortunately, the government has failed to acknowledge this massive crisis and instead undertaken some ad hoc measures; focusing rather on managing headlines. Capital investments in the fertilizer sector are meager and there has been no effort to ramp them up. Of the 943 crores allocated for capital investment in public enterprises in the fertilizer sector, in the 2021-22 budget only 468 crores was spent according to revised estimates. Allocation in the latest budget has been reduced to Rs 654 crores. Although the government brought back price controls through ad-hoc policy changes, the allocation for fertilizer subsidy, the only immediate measure taken to prevent domestic prices from rising, has been slashed by 25 per cent in the recent budget when compared with revised estimates of 2021-22.

Misguided policies of successive governments over the last two decades have exposed a key strategic sector to vulnerability and put India’s food security in jeopardy. The burden on the farmers can only be reduced by assured supply of fertilizers at affordable prices. While price controls and increased subsidies are necessary to prevent fertilizer prices from rising, strategic goals can only be achieved by putting the public sector in the driver’s seat of the fertilizer industry, and making long term plans for securing raw materials and increasing domestic production.

Suresh Garimella is a senior research associate with Society for Social and Economic Research (SSER). Data used in this article have been compiled by Pawan Jangra.